- How to check your land tax online

- Assessment notices

- Reassessments, objections and appeals

- Update your details

Land tax is calculated on the freehold land you own in Queensland at midnight on 30 June, for the next financial year (1 July to 30 June). Annual assessment notices generally begin issuing from August each year and continue for several months. Delays can occur due to a change of land ownership or value.

You will receive an assessment if the non-exempt land that you own in Queensland at midnight on 30 June is:

- $600,000 or more—if you are an individual who mainly resides in Australia or a trustee of a special disability trust

- $350,000 or more—if you are a company, trustee or absentee.

Your assessment will be calculated based on annual land valuations issued by the Valuer-General (Department of Resources).

You should contact us if your assessment has any errors, such as:

- land that you did not own at 30 June is included

- land that you owned at 30 June is excluded

- the new value of land that was revalued is not shown

- exemptions or sub-divider discounts are applied incorrectly.

In some cases, the property address for your land may differ from its actual street address. This is because other government agencies and authorities may have a different address on their records. A reassessment of your land tax will not be needed as long as the property ID and property description shown on the assessment are correct.

If you believe an incorrect decision was made about your assessment and you have taken all other steps to resolve your concerns, you can object.

Exempt land

Generally, land tax exemptions are not automatic—you must apply for them. For land with joint owners, each owner wanting to claim an exemption must apply separately. Depending on the information that we have, you may receive an exemption for land used as your home without having to apply. In these situations, we’ll send you a notice about the exemption that has been applied and the date of effect.

If your assessment notice includes exempt land (e.g. your home), make sure you have applied for an exemption before you consider lodging an objection.

You can apply for and track the progress of home and primary production exemption claims online. Once we have processed an exemption claim, we’ll send a reassessment notice if the exemption is approved.

View your assessment notice online

You can receive your assessment notice and view previous year notices through your QRO Online account.

To set up online assessment notices:

- Go to Assessments in the menu and select I agree.

- Go to Manage details and select Land tax service address.

- Select Email address and enter your details.

When you tick the box to receive online notices, you won’t receive your assessment notice by post. We’ll send you an email when your notice is ready to download.

Make sure you keep your contact details up to date. It’s also a good idea to:

- add @treasury.qld.gov.au to your email program’s safe senders list so that our emails to you don’t end up in your email junk folder

- set a reminder in your personal calendar to log in to QRO Online in July each year to check your details.

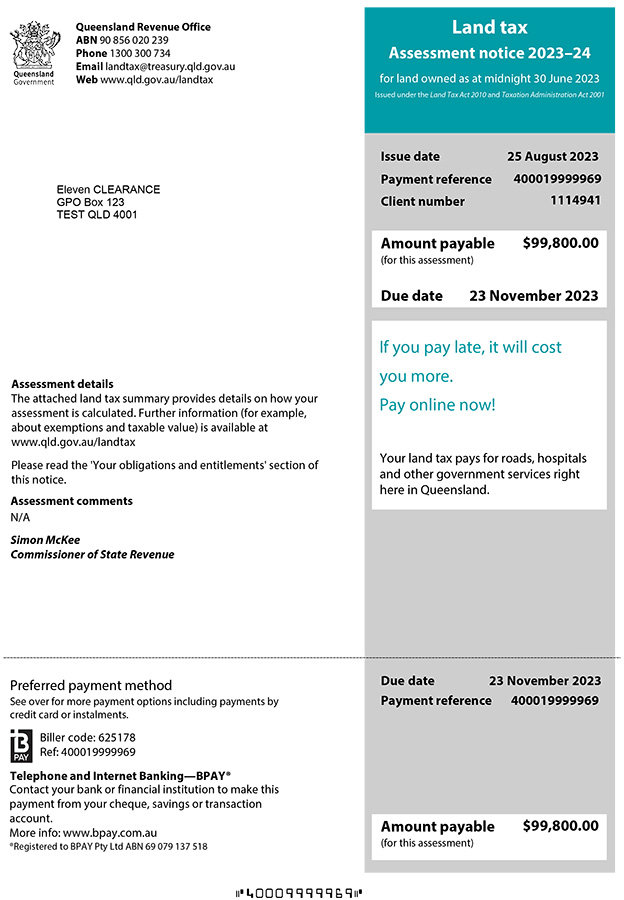

The information on your assessment notice

The assessment notice contains the information you will need to understand how your land tax was calculated and how to pay it.

Front page

- Payment reference—This number is unique to each assessment notice. You need to include this when paying your liability.

- Client number—Quote this number when speaking to us about your land tax.

- Amount payable and due date—This is the amount of land tax you owe and when it is due.

Back page

- Payment options—Your payment options are outlined here. Remember to use the payment reference shown on the front when paying.

- Direct payments—You can pay your land tax using direct debit, either in 1 payment or using the extended payment option (EPO), which allows you to pay over a longer period in 3 instalments.

Land tax summary

- An itemised list shows the separate charges that make up your land tax liability.

- The absentee or foreign surcharge (if applicable) will appear here.

- Property address, ID and description—These identify the property on which your land tax has been assessed, including land solely owned by you and land you own jointly with others.

- Taxable value—Your land tax has been calculated on these values.

- Exemptions—Any exemptions that apply to your land will be noted by an exemption code. No taxable value will be shown where land receives a full exemption.